Using China’s digital currency could be just like using Apple Pay

In addition to QR codes, the digital yuan app might also use NFC, allowing people to pay with a tap of their phone

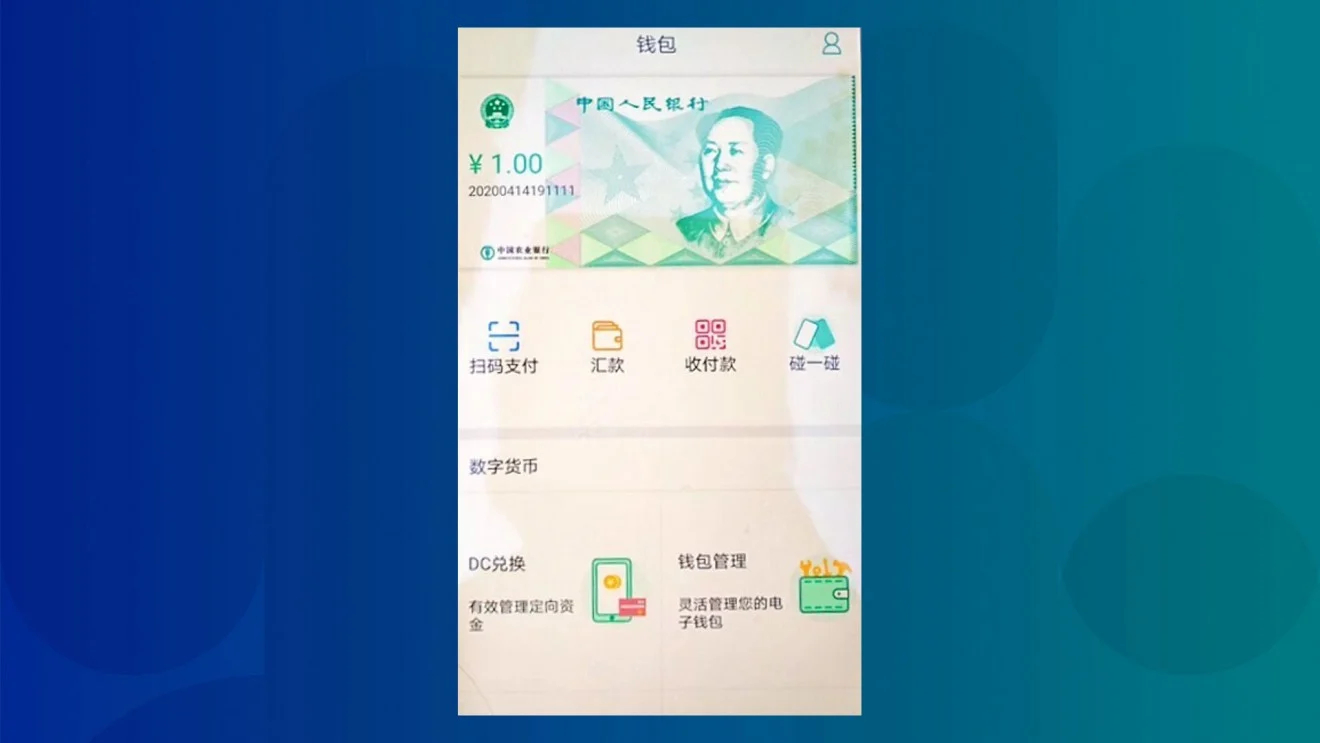

China is aiming to become the first country to roll out its own digital currency. But it looks like actually using the new digital yuan could look a lot like other popular mobile payment apps like Apple Pay or Google Pay.

“The digital currency can be conveniently used without the internet,” Dong said. “Users can make transactions or payments by bringing two mobile phones with electronic wallets close to each other.”

Dong’s explanation sounds similar to how many digital wallets work these days. Users can exchange money in their bank accounts for the digital currency, which is then deposited in an electronic wallet, Dong said.

The interface looks a lot like two popular mobile payment solutions in China: Alipay and WeChat Pay. It includes a function called “touch and touch,” which allows two people to simply touch their mobile phones together to make a transfer.

(Abacus is a unit of the South China Morning Post, which is owned by Alibaba, an affiliate of Alipay owner Ant Financial.)

How the QR code conquered China

China’s push to roll out its digital yuan could make it the first country with its own digital currency. But the digital yuan is tightly controlled by the central bank, meaning it’s not a separate currency floated on the market like decentralized digital currencies running on a blockchain. Digital currencies like Facebook’s Libra or Bitcoin act more like virtual commodities. They’re not considered legal tender, Dong explained.

However, Dong Ximiao noted that digital money will not replace cash payments, at least not in the short term. Similar to how paper currency is distributed now, the country’s central bank, PBoC, will issue the digital yuan to local commercial banks. It will then be distributed to customers.