Shopping in live streaming apps is booming in China thanks to the Covid-19 pandemic

Buyers like the experience of seeing the products in live-streamed video, but they also worry about false marketing and scams

Welcome to shopping in the age of the coronavirus pandemic. After physical retail locations were forced to stay closed for weeks, some merchants have turned to live streaming to remotely connect with buyers. Shanghai New World chose to stream on Douyin, the Chinese version of TikTok. Over those three days, the mall reportedly gained 10,000 followers.

But other tech companies offer similar services. A number of Chinese museums and the New York Metropolitan Museum recently started live streaming exhibits and selling gifts through Pinduoduo.

As a result, China’s biggest ecommerce and live streaming platforms have been pouring in to take advantage of the trend. And this year, they’ve been seeing some big gains.

Bilibili, China’s biggest anime site, covers the screen in user comments

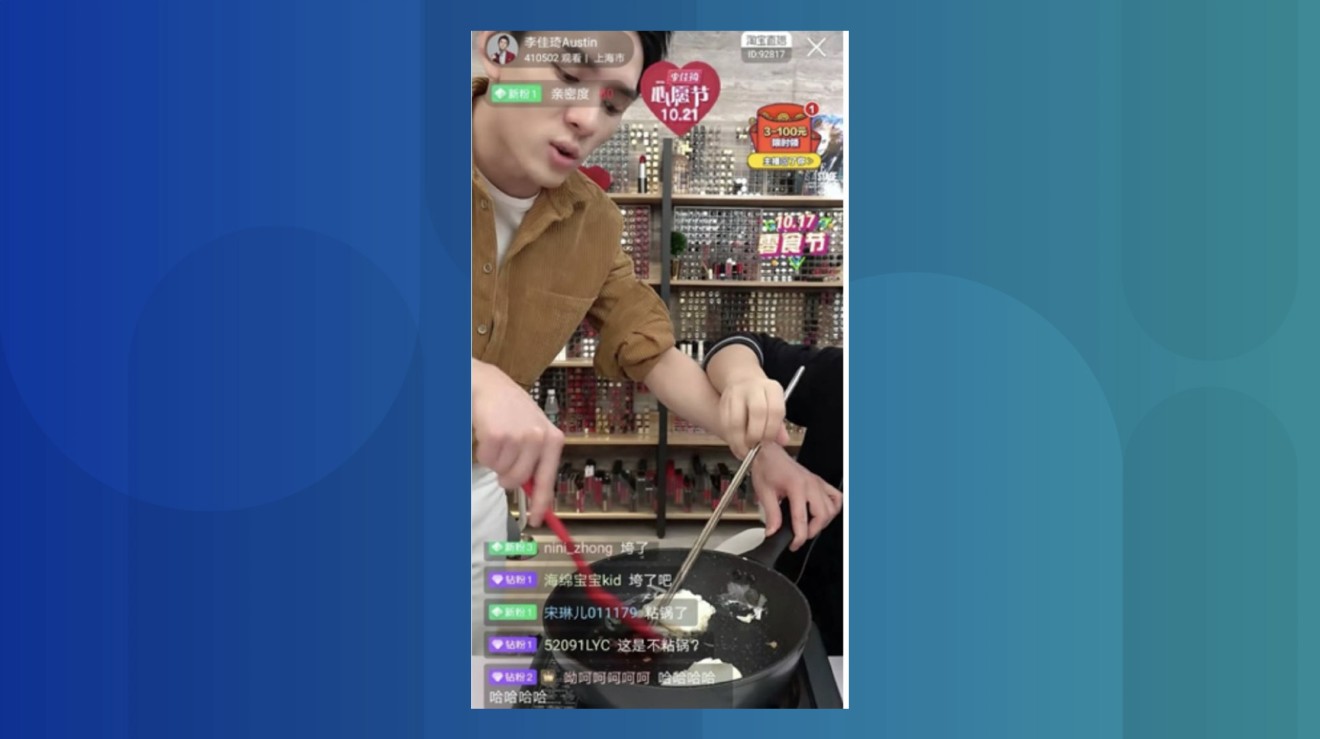

But the biggest live streaming shopping site is Alibaba’s ecommerce platform Taobao. Out of 5,333 users surveyed by the Consumer Association, 70 per cent said they use Taobao. Taobao said the number of merchants using live streaming for the first time surged 719 per cent from January to February.

(Abacus is a unit of the South China Morning Post, which is owned by Alibaba.)

Douyin came in second with 57.8 per cent saying they used it for shopping and then Kuaishou at 41 per cent. Even platforms typically associated with video game live streaming offer a shopping function, with some people buying goods though Huya and Douyu.

But live streaming has also become the subject of scrutiny as a result of negative user experiences. The Consumer Association’s survey shows nearly 40 per cent of users have run into problems – the biggest among them being exaggerated and false marketing.

Another worry among consumers shopping through live streaming is the possibility of fake goods, according to the survey. The association’s report points out that many of the platforms hosting the streams don’t process payments themselves, instead relying on third-party platforms. This could make them difficult for the streaming platforms to police in the event of a scam.

Sign up now and get a 10% discount (original price US$400) off the China AI Report 2020 by SCMP Research. Learn about the AI ambitions of Alibaba, Baidu & JD.com through our in-depth case studies, and explore new applications of AI across industries. The report also includes exclusive access to webinars to interact with C-level executives from leading China AI companies (via live Q&A sessions). Offer valid until 31 May 2020.