China’s gaming market falls to #2 amid tightening regulations

Some netizens don’t care about the US retaking the top spot, but developers worry about Chinese talent

Rapid growth in China’s gaming industry in recent years might have led some to think it was invulnerable. Now it looks like a bleaker regulatory environment is taking a toll.

A new report on the gaming industry this year shows the US is poised to once again become the world’s largest gaming market since it was overtaken by China in 2015. While some Chinese netizens said their country doesn’t need this dubious honor, others think the industry, which has been recently hit hard by regulations, needs a shot in the arm.

As growth slows, publishers and developers have gotten concerned, too.

“I think the future will bring more regulation, but hopefully [there will be] more detailed guidelines on how to enter the market, and a clear vision for the next [few] years,” Wong said.

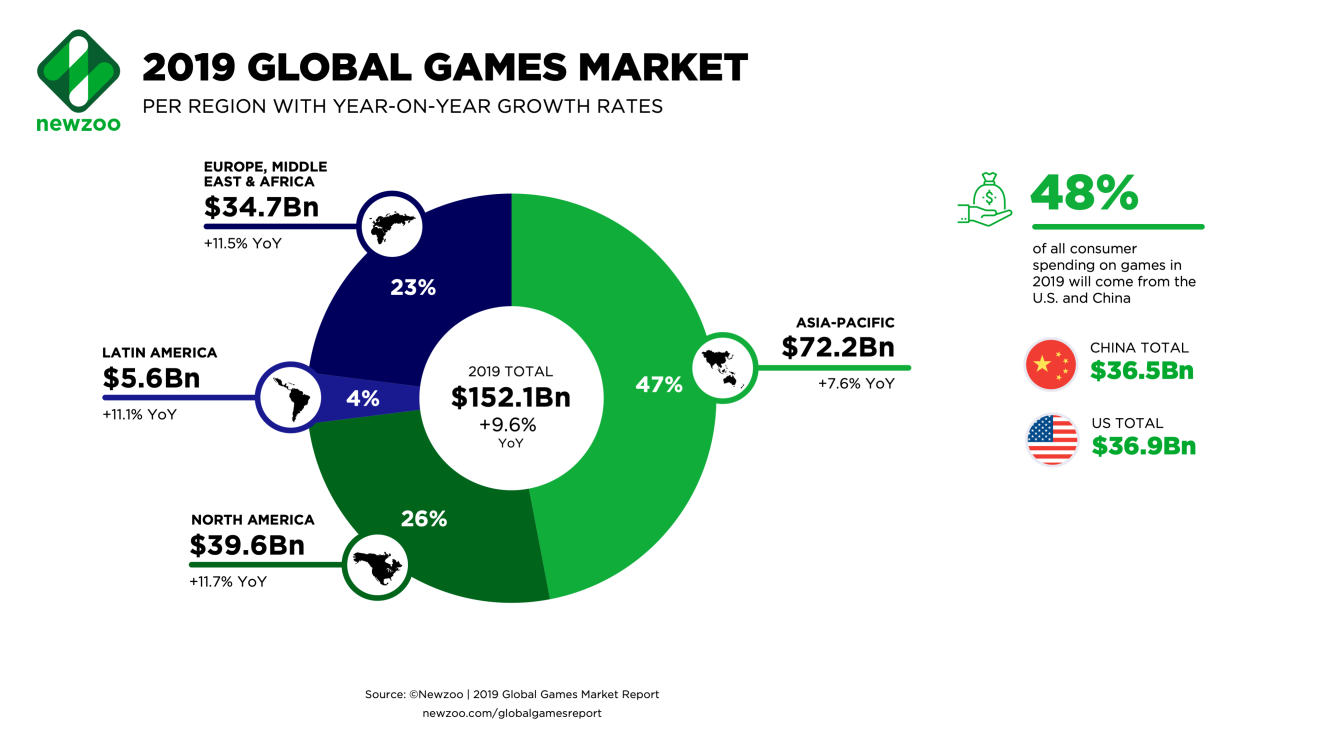

Combined revenue from China and the US will account for 48 percent of the estimated US$152.1 billion in global gaming revenue.

After a Chinese media revealed the new forecast on Monday, netizens had mixed reactions.

Breaking down China's most popular news app, Toutiao

Many believe that Chinese people should spend more of their time and resources on other things. However, others suggested the Chinese government shot itself on the foot.

“This is clearly the result of our own crackdown,” another comment on Toutiao said. “If you truly open up the market, you’d be hard-pressed not to find us ahead of the US.”

Whether people care about being the top market or not, it does appear that China’s dialed-up gaming regulations contributed to slower growth.

“[Startups] have two options: Market their game outside of China, or cooperate with Tencent and Netease,” he said. “I don't think either of those are great options for developers in China, because marketing a game overseas is difficult, and Tencent and Netease have enough leverage to put small developers in poor negotiating positions.”

Mini Programs: The apps inside apps that make WeChat so powerful

“In China, Tencent’s WeChat mini games are most prominent, already solidifying themselves within the Chinese games ecosystem,” Newzoo said. “Game developers in China have already seen huge potential in this market.”

Some remain skeptical about how much momentum mini-games can really provide the industry as a whole.

There are also those who worry that with all the regulatory headwinds, companies’ continued focus on profits in casual mobile games might end up hindering the growth of domestic talent in the industry.

Zhihu, where people in China go to ask questions and get answers

“As the tidal wave of mobile games washed over one batch of developers after another, those who had experience in working with AAA games and game engines have either left the industry or become out of step [with the latest tools],” he said.

He added that the industry is seeing a shortage of mid-level talent, as well.

“Mid-level talent is few and far between,” he said. “Most of the developers who have five to six years of experience today have only made simple mobile games.”

For more insights into China tech, sign up for our tech newsletters, subscribe to our Inside China Tech podcast, and download the comprehensive 2019 China Internet Report. Also roam China Tech City, an award-winning interactive digital map at our sister site Abacus.