Consumers say Amazon failed in China because it didn't adapt

Chinese consumers said Amazon couldn’t compete with local ecommerce behemoths Alibaba and JD

Once its store is closed, Amazon shoppers in China will no longer be able to buy goods from third-party merchants in the country. Instead, they will only be able to order products from Amazon’s global store.

The announcement doesn’t mean one of the world’s most valuable companies is completely withdrawing from China, though. The company intends to focus more on selling overseas goods and cloud services in the country.

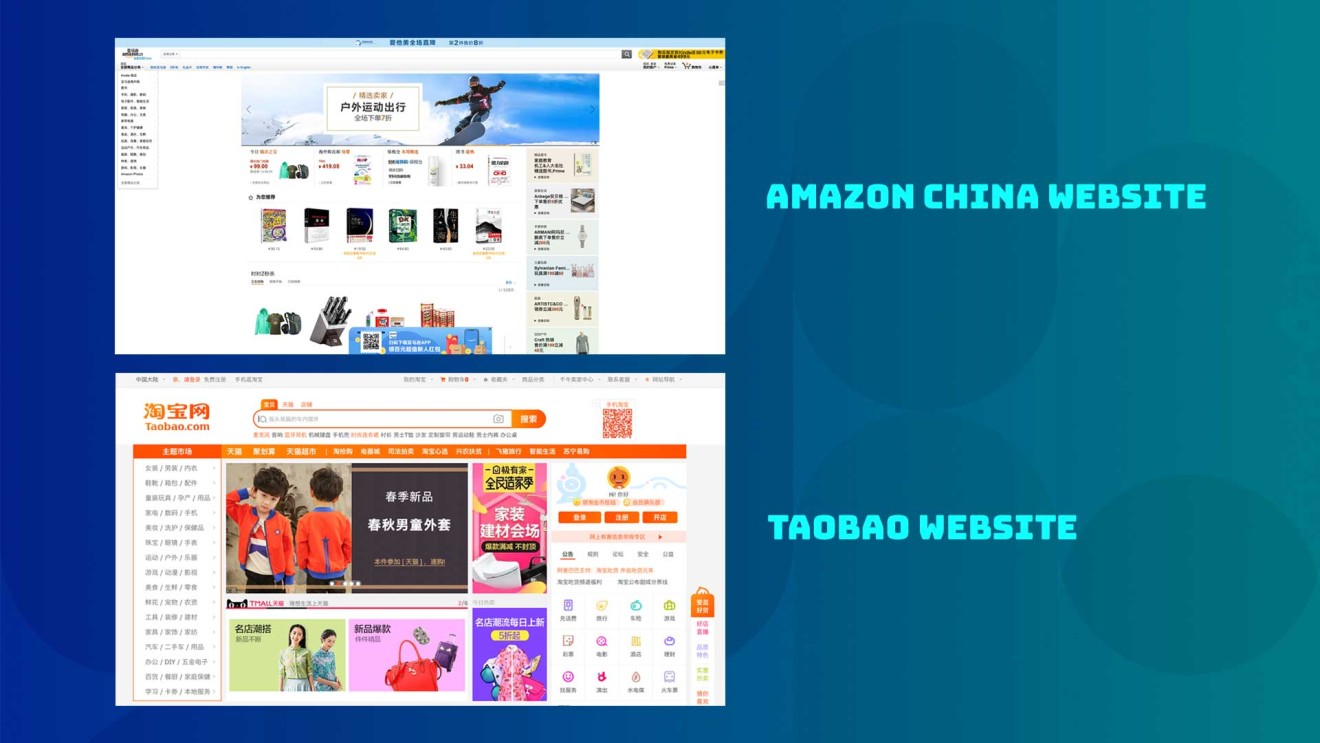

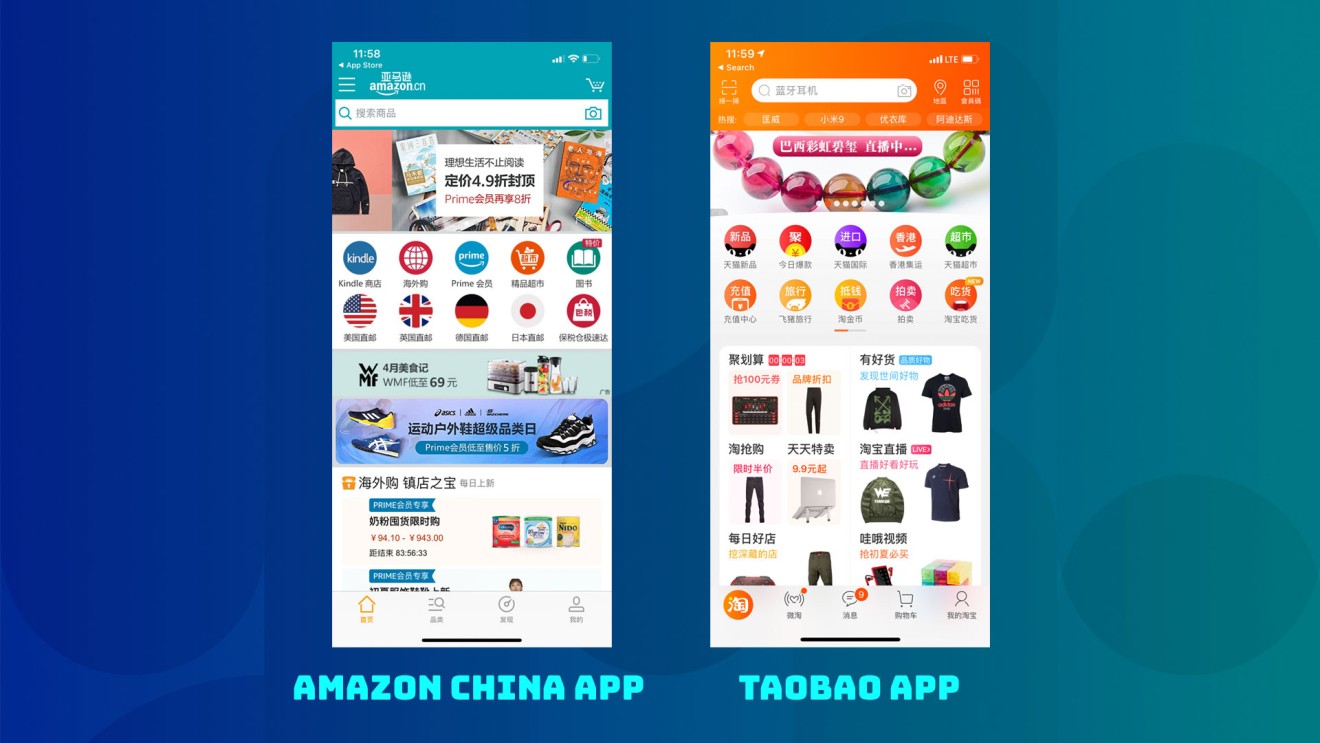

The most common example of Amazon’s failure to adapt is the company's website design. It turns out Chinese consumers don’t care for the relatively clean web design Amazon deploys on all its sites. In China, ecommerce sites like Taobao and JD.com are much more cluttered, cramming more goods onto a single screen.

Amazon’s Chinese site has already seen a lot of changes, according to the employee, but getting those changes done was difficult and took a long time.

Jack Ma and Richard Liu defend China’s overtime work culture, but ordinary workers can’t relate

Amazon isn’t the first US ecommerce company to fail to adapt to China. Online auction king eBay, which was the first major ecommerce firm in China, failed for a similar reason 13 years ago.

Today, Chinese ecommerce companies dominate the domestic market, with Alibaba and JD.com taking up more than 81% of it.

(Abacus is a unit of the South China Morning Post, which is owned by Alibaba.)

While many blame Amazon’s obstinance for its failure in China, some consumers sympathize with the Seattle-based company. They note the many challenges that Amazon faces in the country, including endless price wars that eat into profits and the constant battle against knockoffs.

Although it is common to see Western tech companies struggle in China because of cultural differences, Chinese consumers don’t blindly prefer local brands.

So maybe there is still a chance for Amazon. The company’s statement said, “Amazon’s commitment to China remains strong. We will continue to invest and grow in China across Amazon Global Store, Global Selling, AWS, Kindle devices and content.”

If Amazon carves out a successful niche, there’s plenty of money to be made in China’s thriving ecommerce market.

For more insights into China tech, sign up for our tech newsletters, subscribe to our Inside China Tech podcast, and download the comprehensive 2019 China Internet Report. Also roam China Tech City, an award-winning interactive digital map at our sister site Abacus.