Advertisement

Advertisement

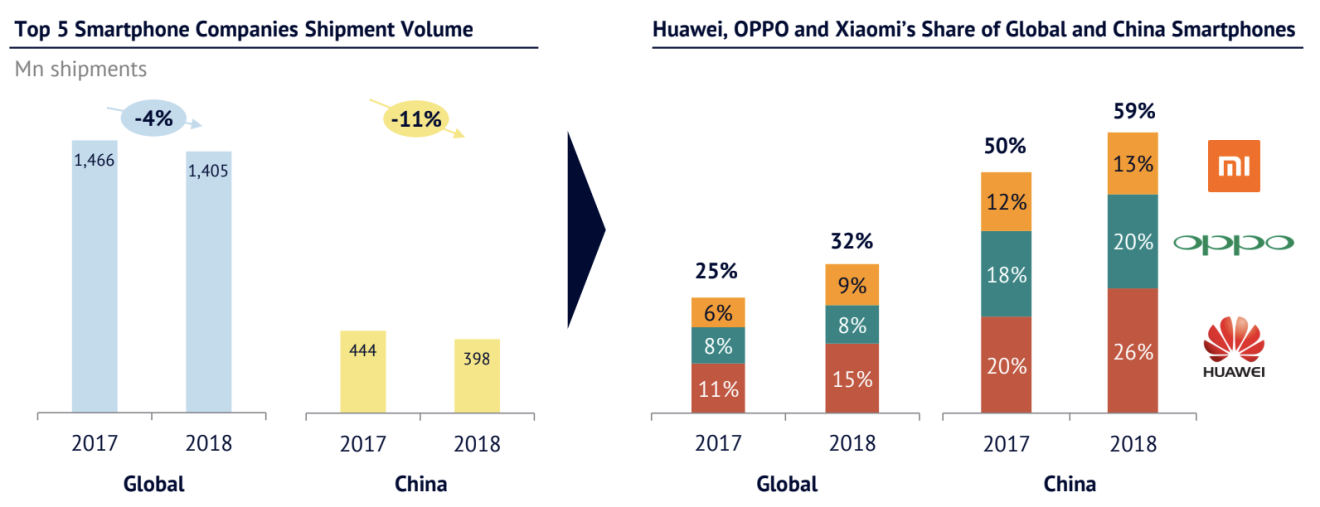

Chinese brands thrive in a slowing smartphone market

Huawei, Xiaomi and Oppo fared well last year, but US-China trade war casts shadow

This article originally appeared on ABACUS

If you happen to have just bought an expensive Android phone, chances are you waited more than two years before upgrading. Around the world, people are holding onto their handsets longer, with iPhone owners staying put for close to three years on average.

Smartphones aren’t flying off the shelves as quickly as they once were, but it isn’t bad news for everyone. It turns out that while big brands like Samsung and Apple both sold fewer phones last year than in 2017, Chinese brands like Huawei and Xiaomi performed far better. They both saw double-digit growth in shipments despite the slowing market, allowing them to raise their market share globally, according to the China Internet Report 2019.

The positive trend largely continued into the first quarter of this year, when Huawei leapfrogged Apple to become the world’s second largest smartphone vendor. How did Huawei do it? By shipping a whopping 50% more phones than during the same period in 2018.

Xiaomi, despite seeing shipments fall in the first quarter, was still the world’s fourth best-selling brand.

Vivo is another rising star. Largely unknown in the US, the Chinese brand managed to ship 24% more phones, making it into the top five. Its parent company, BBK Electronics -- which also owns Oppo and OnePlus -- is now considered the world’s third largest phone maker.

All in all, 2019 was shaping up to be a good year for Chinese brands… until the tech war hit.

In May, the US banned Huawei from doing business with American companies on national security grounds. The move blocked American tech firms from selling to Huawei, meaning Google couldn’t license apps like Google Maps, YouTube and even the Play store to the Chinese company for future devices. This was a huge blow to Huawei’s overseas market. It also means Huawei would no longer have access to chipsets based on US-designed technology, something that it relies on heavily for major phone models.

The potential impact is huge. Soon after the US ban was announced, Huawei predicted a drop in smartphone shipments by up to 60 million units, according to a Bloomberg report. That’s more than a third of all smartphones it shipped in 2018.

President Trump has since softened his stance, suggesting he’ll allow US companies to sell to Huawei again as long as there’s no national security concerns. Some tech firms like Intel also believe they’ve found a legal way to keep selling to Huawei. But with trade talks still ongoing, it remains to be seen how this will eventually play out.

For now, it looks like Huawei is looking to offset whatever ground it’s losing overseas by shifting the focus back home. Since Huawei phones sold in China don’t come with Google services anyway, the Google ban, whether it still stands, isn’t expected to impact domestic consumers.

Xiaomi, Vivo and others are likely taking note.

Huawei was already the best-selling smartphone brand in China before the trade ban. While other Chinese brands have yet to suffer considerable impact from US-China tensions, they are now under pressure to compete with a domestic giant that's stepping up its game at home.

As competition heats up, companies are exploring new strategies to differentiate themselves. Oppo recently took the wraps off the world’s first smartphone that hides a camera under the screen, while Xiaomi launched a smartphone that specifically targets young women.

For more insights into China tech, sign up for our tech newsletters, subscribe to our Inside China Tech podcast, and download the comprehensive 2019 China Internet Report. Also roam China Tech City, an award-winning interactive digital map at our sister site Abacus.

Post