Chinese tech startups are targeting emerging markets to make their mark

Startups seek success in Southeast Asia, India and Africa as China’s tech scene becomes too crowded

China’s rapid growth has created a slew of popular platforms such as Alibaba’s Taobao and Tmall, Tencent’s WeChat and ByteDance’s Jinri Toutiao and Douyin, known as TikTok abroad. They all have leading positions in China, but now companies are looking to conquer less crowded markets. In some cases, local startups are skipping their home market altogether for uncharted territories, bringing along their ideas and business models.

(Abacus is a unit of the South China Morning Post, which is owned by Alibaba.)

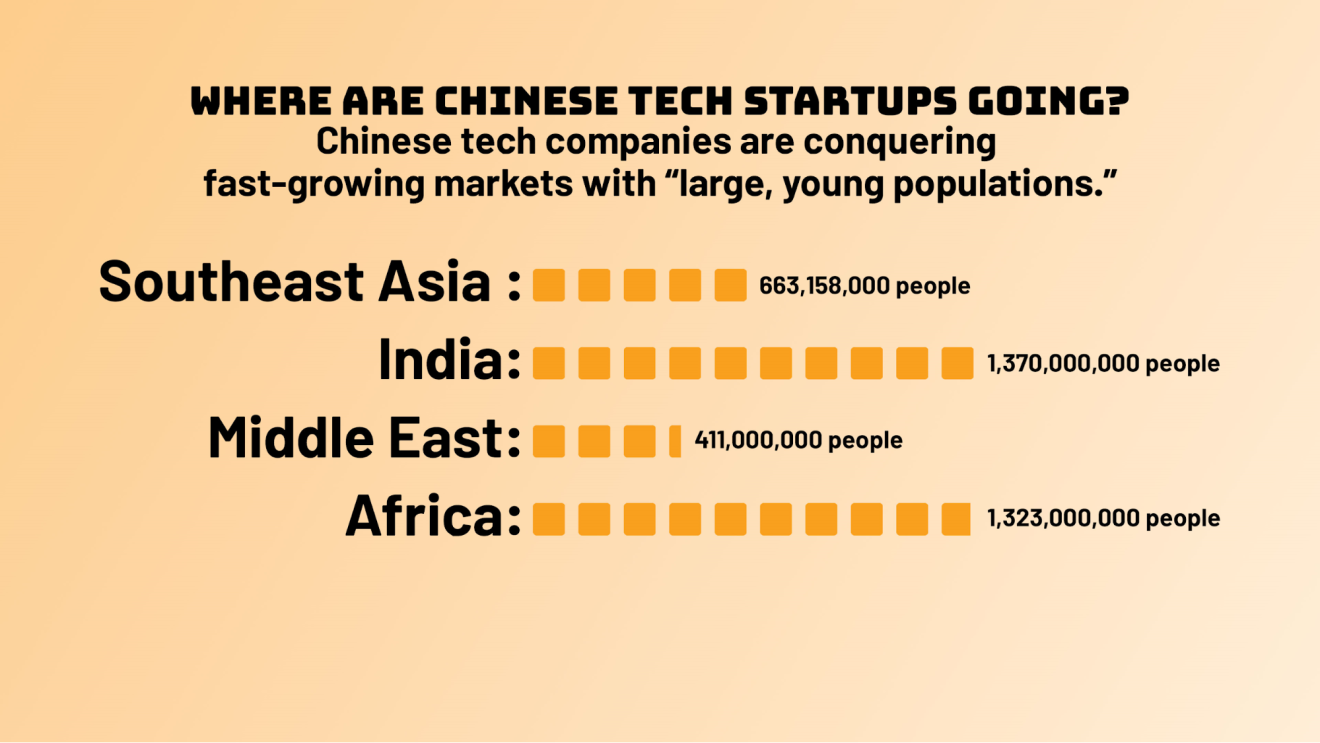

The big markets now for Chinese startups? The Middle East, Africa, India and Southeast Asia.

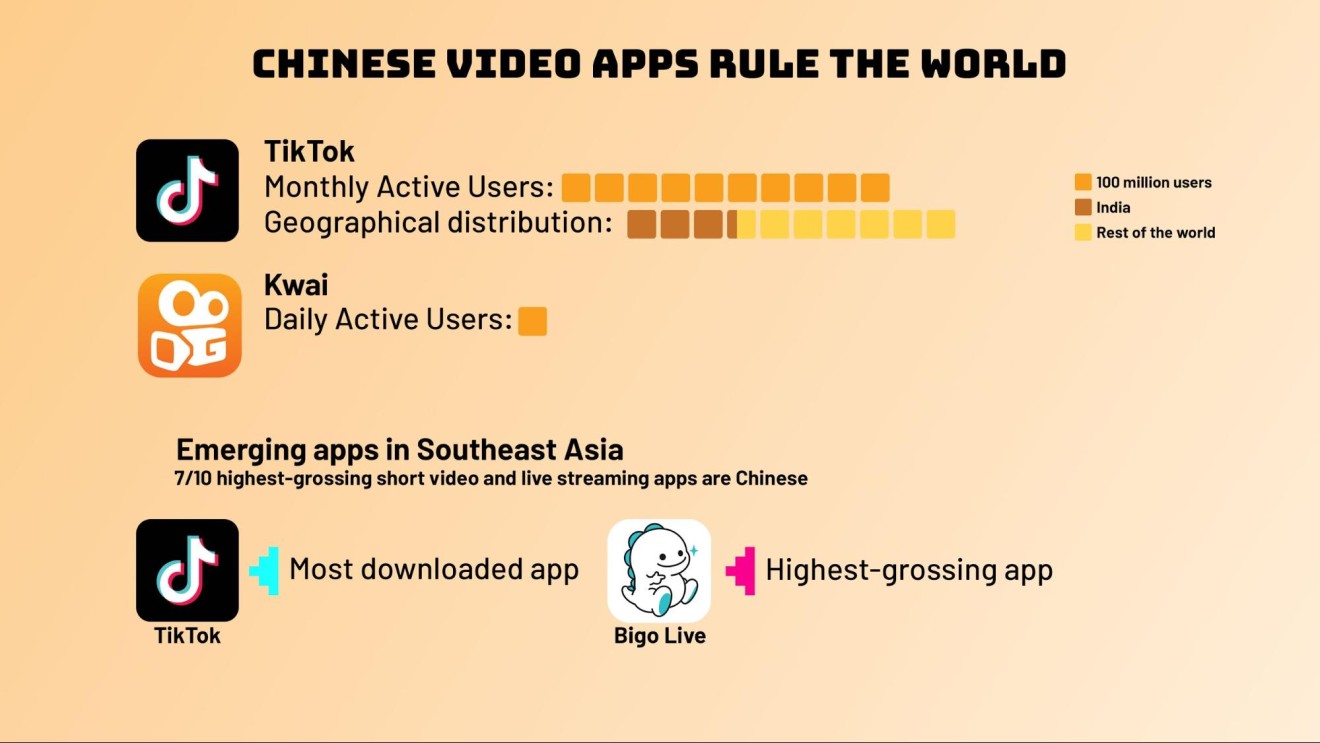

One of the first Chinese technology products that truly conquered the world was the short video app TikTok. Startups are now trying to replicate its success, especially in Southeast Asia, where the majority of high-grossing short video and live streaming apps are made by Chinese entrepreneurs.

TikTok, the viral short video sensation, has its roots in China

A case in point is live streaming company Bigo Technologies, founded by Chinese entrepreneur Xueling Li, co-founder and CEO of live streaming company YY Inc. Bigo Live became the highest-grossing video app in Southeast Asia, according to SensorTower.

In fact, among the region’s top 10 short video and live streaming apps, seven of them are made in China, including VivaVideo, EleLive and UpLive.

Compared with their Western competitors, Chinese companies have a particular edge in developing regions. Companies like Alibaba and Tencent, which started in the late 1990s, have already overcome challenges facing developing and emerging markets today. These countries often have inefficient payment systems, poor logistics networks and lower incomes.

The biggest phone seller in Africa is a little-known Chinese company

Africa’s ecommerce gap proved to be an opportunity for former Huawei employee Yang Tao, who decided in 2014 to set up his own ecommerce site in Kenya called called Kilimall. The idea came from his own frustration over the country’s shortage of goods. Many African countries still lag behind in manufacturing and rely on raw material exports.

Another challenge for emerging markets is the lack of access to credit. In Indonesia, for example, many people don’t have credit cards. That’s why Chinese entrepreneurs Li Wenbo and Hu Bo started Akulaku, giving Indonesians an opportunity to pay for products in installments when they don’t have the cash upfront.

Across the world, Chinese tech startups are making their way into markets where people are now buying smartphones at a fast rate and going online in great numbers. As these economies continue to undergo rapid transformation, they’re supplying ever more buyers for a wide range of goods and services, from mobile payments to gadgets.

For more insights into China tech, sign up for our tech newsletters, subscribe to our Inside China Tech podcast, and download the comprehensive 2019 China Internet Report. Also roam China Tech City, an award-winning interactive digital map at our sister site Abacus.